how much is virginia inheritance tax

In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth. As of 2019 if a person who dies leaves behind an.

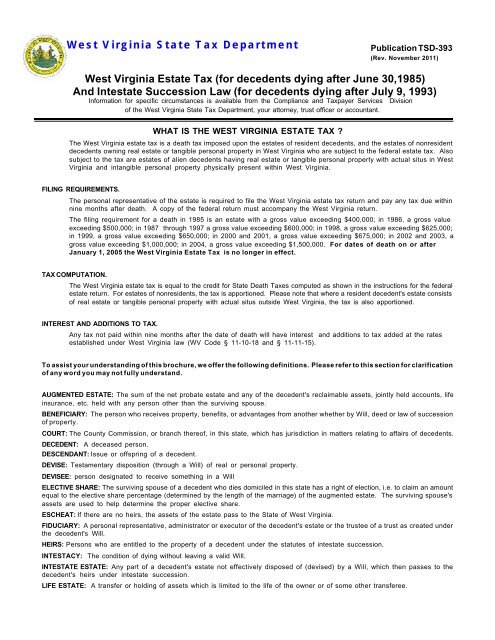

What Is The West Virginia Estate Tax Publication Tsd 393

Your average tax rate is 1198 and your marginal tax rate is 22.

. The top estate tax rate. States may also have their own estate tax. If you make 70000 a year living in the region of Virginia USA you will be taxed 12100.

If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M. The federal estate tax is due nine months from the date of death and is currently filed. 13 hours agoThe top easy access account now pays 235pc while the highest-paying one-year bond is at 425pc.

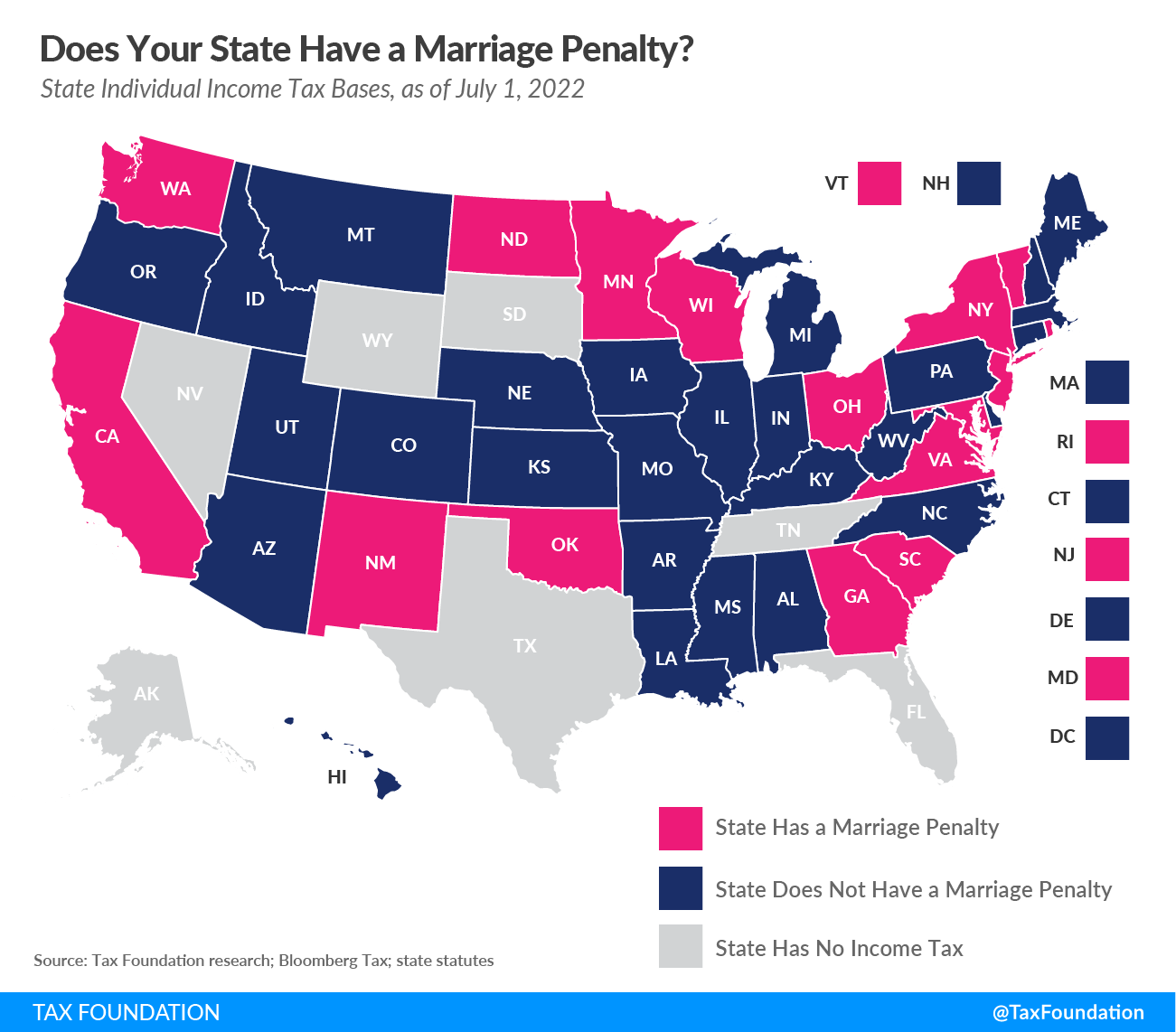

As of 2021 the six states that charge an inheritance tax are. Click the nifty map below to find the current rates. Price at Jenkins Fenstermaker PLLC by.

The top estate tax rate is 16 percent exemption threshold. Today Virginia no longer has an estate tax or inheritance taxPrior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. Generally Virginia does not require an estate tax return unless there is a federal estate tax return due.

Virginia Inheritance and Gift Tax. See where your state shows up on the board. Three-year bonds offer returns as high as 475pc.

Who has to pay. If you dont know what inheritance tax is you probably. But just because Virginia does not have an estate tax does not mean one is not assessed at the federal level.

These states have an inheritance tax. Virginia estate tax. Prior to July 1 2007 Virginia had.

How much is virginia inheritance tax. This is great news for Virginia residents. Inheritance tax rates differ by the state.

The tax shall be an amount computed by multiplying the federal credit by a fraction the numerator of which is the value of that part of the gross estate over which Virginia has. Some states have inheritance tax some have estate tax some have both some have none at all. You might inherit 100000 but you would pay an inheritance tax on only.

This marginal tax rate means that. How much can you inherit without paying taxes in 2020. How much can you inherit without paying taxes in virginia.

The estate tax rate is 40. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

New Jersey Estate Tax Changes Mccarthy Weidler Pc

Virginia Estate Tax Everything You Need To Know Smartasset

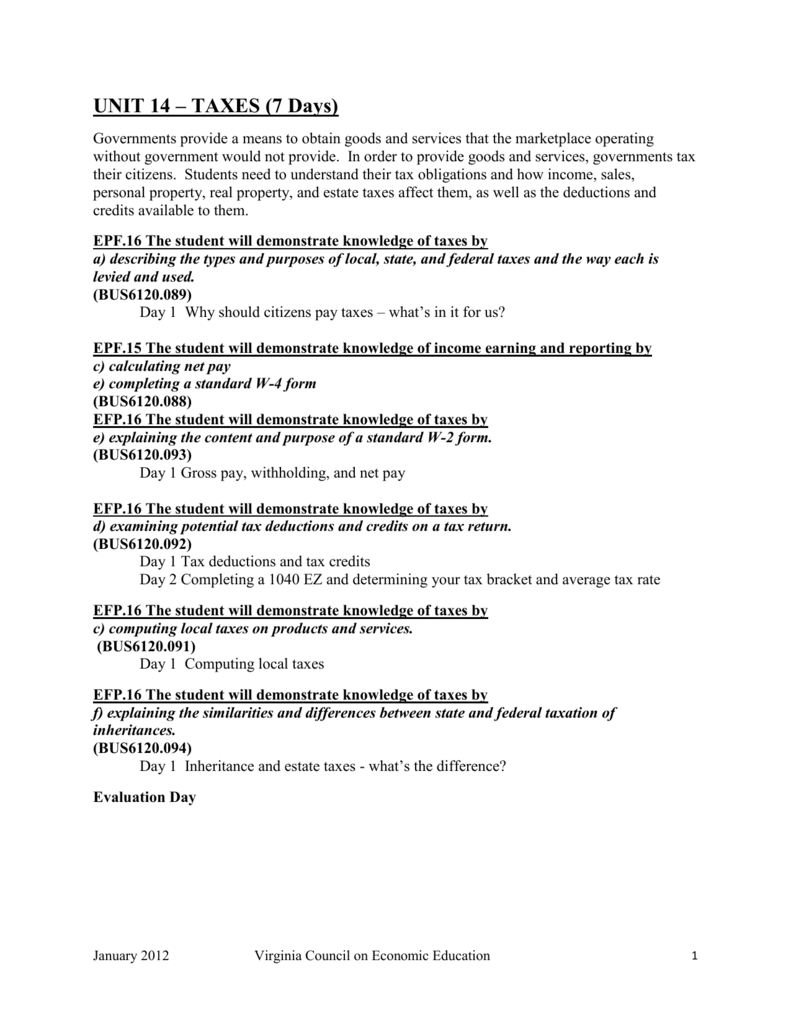

Unit 14 Taxes 7 Days Virginia Council On Economic Education

Federal Estate And Missouri Inheritance Taxes Legacy Law Missouri

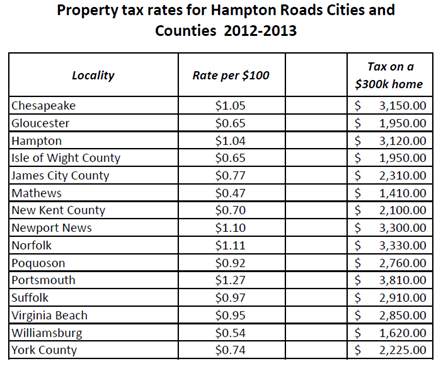

Hampton Roads Property Tax Rates 2012 2013 Mr Williamsburg

Transfer On Death Tax Implications Findlaw

Virginia Ggu Tax Estate Planning Review

Virginia Estate Tax Everything You Need To Know Smartasset

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

Estate Taxes They Re Not Dead Yet C Douglas Welty Plc

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Virginia Lawyer Va Lawyer Feb 2015

Free Virginia Tax Power Of Attorney Form Pdf

Severance Taxes Urban Institute

State Estate And Inheritance Taxes Itep

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Analyst Northern Virginia Suburbs Likely Immune From Dropping Home Prices News Arlington Insidenova Com